Their expertise helps mitigate financial risks and improve overall financial health, offering tailored solutions for your bookkeeping needs. Over the past decade, many companies have decided to outsource these functions to professionals because they can have a tremendous long-term impact on their business. Is it time to invest in additional people and new software to boost your business’ efficiency?

The Ideal Accounting Department

- From preparing accounting policies and disclosures to outsourced accounting support, we provide comprehensive accounting assistance.

- Cutting overhead and getting better financial leadership is critical to the success of all companies.

- Their service effectively reduces the workload on internal staff, allowing businesses to focus on growth and strategic decision-making.

- The Essential plan ($249 a month if billed annually or $299 billed monthly) focuses on bookkeeping only, giving you access to a dedicated team that performs monthly bookkeeping services.

- If you’re a small business that manages its own books, you could be spending your time and resources elsewhere.

You have to enter more information about your needs to get a quote—which is useful if you want truly customized services but unhelpful if you’d rather choose a basic plan out of a lineup. And on the accounting software front, Bookkeeper360 syncs with both Xero and QuickBooks Online. That means you won’t get to spend as much face-to-face time with your accountant as you would if they were your employee. If you’re bringing profit center: characteristics vs a cost center with examples in an outsourced controller to help manage your existing team, it’s necessary to carefully consider what this relationship will look like. If you’re the type of person who likes to shake someone’s hand and look them in the eye, the remote nature of outsourced accounting may require some adjustment. This is not a complete list of benefits that businesses can expect when partnering with an outsourced accounting firm.

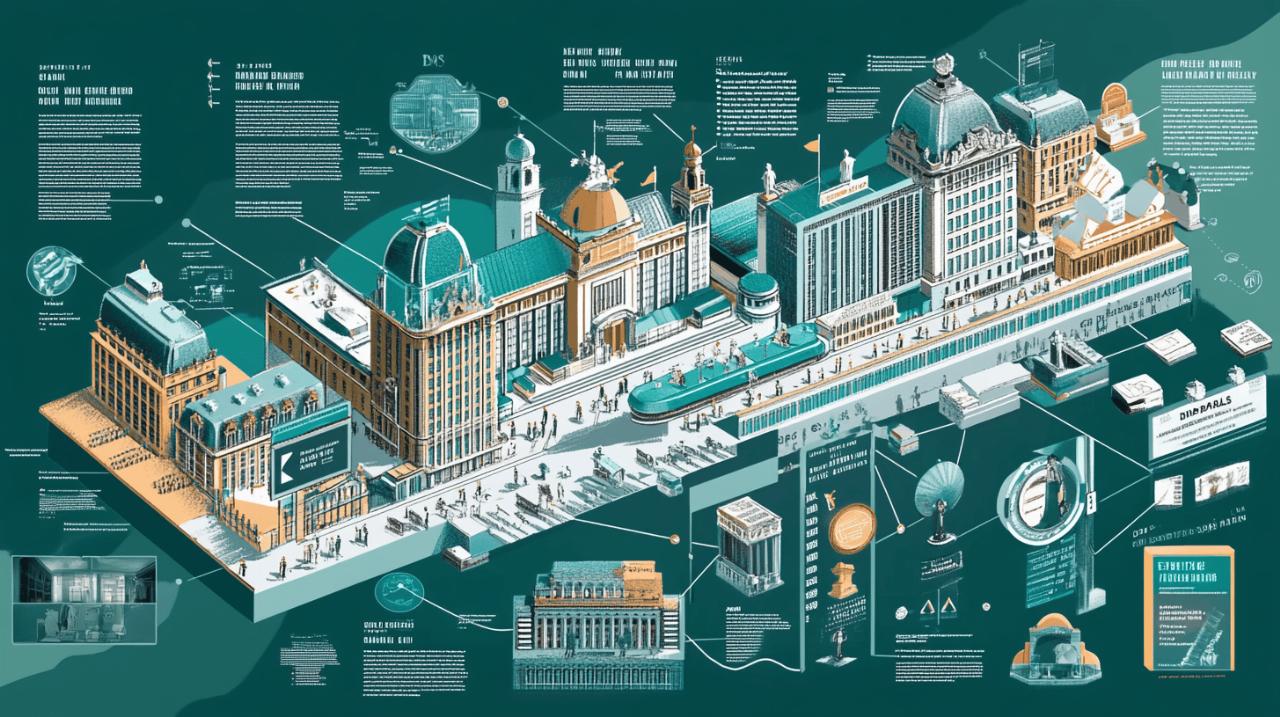

The Complete Guide to Outsourced Finance and Accounting Services 2022

It is operated by domain experts to improve cash flow, finance function, customer satisfaction and sales effectiveness. We can help you achieve your priority outcomes with intelligent workflows and process automation. Improve efficiency of P2P processes, create smart functions that find, connect and analyze data to uncover deeper insights and inform intelligent decisions.

The 8 Best Virtual and Outsourced Accounting Services for Small Businesses in 2023

With many aspects of finance and accounting fitting the bill as transactional and/or rules-based, such jobs lend themselves to outsourcing and, in turn, ease the pressure on small and medium-sized businesses. Whether you’re a startup aiming to minimize overhead costs or a seasoned enterprise seeking to focus on core competencies, outsourcing finance and accounting offers a myriad of benefits. In this article, we delve into the world of finance and accounting outsourcing, understanding the landscape, and listing the top outsourcing providers in this domain. Looking for a scalable outsourced bookkeeping service with flexible payment options? Every inDinero plan includes a dedicated account manager, direct employee reimbursements, some inventory management, and payroll assistance.

Our Services

Be it startups, small to medium-sized businesses, or non-profit organizations, outsourcing offers major advantages. When you outsource, you can leverage the expertise and experience of firms who are already established in those markets. This ensures that your tax and legal obligations are being handled by local accountants the income statement who understand local tax laws and regulations, and who are sufficiently qualified. It can be difficult to understand the benefits of partnering with an outsourced CFO before starting to work with one. Many times, businesses have all kinds of hidden opportunities hidden in their internal systems and accounts.

DV Philippines emerges as a distinguished player in the finance and accounting outsourcing field, specializing in providing top-notch services tailored to a diverse international clientele. Their expertise lies in offering a comprehensive suite of finance and accounting services, including but not limited to bookkeeping, financial reporting, and CFO services. DV Philippines’ commitment to quality and client-centric approach makes them a standout choice for businesses seeking a reliable and globally competent finance and accounting outsourcing provider. Finance and accounting outsourcing is the practice of entrusting a company’s financial services and operations to external experts. This process involves hiring third-party service providers to manage various financial tasks such as bookkeeping, accounting, tax preparation, and financial reporting.

If needed, a highly experienced professional may also provide additional accounting and finance consulting, which is priced according to each company’s specific needs. If you feel now is the best time to start outsourcing your accounting department, you have a choice of firms that specialize in it. Although you may lose some control, you can devise ways to mitigate that while increasing your business’s efficiency.

These resources may be particularly beneficial for small and mid-sized businesses that may not have robust IT departments or stringent confidentiality measures. In-house accounting involves hiring and training internal staff to handle financial tasks. Outsourced accounting relies on external experts who are already equipped to manage a businesses’ financial operations. The third-party accounting company acts as an in-house accounting department and may provide extensive support, as well as offer more advanced services such as CFO and controllership advisory services. Unlike the accounting department, the treasury department consists of people that have actual access to the bank accounts and cash—don’t confuse the two! To avoid not just fraud or embezzlement, but also financial mistakes, you should rely on key individuals in your business for treasury access rather than outsourced accountants.

Outsourcing is an excellent way to reduce costs and increase efficiencies but it is essential to partner with a provider that is right for your business and that starts by ticking a few key boxes. This shift is not just a trend but teaching ratios and unit rates in math a pivotal move for businesses aiming to harness specialized expertise, optimize cost-efficiency, and stay agile in a competitive global market. Would you rather tackle accounting yourself instead of outsourcing it to a third party?

Depending on your business needs, there can be advantages to outsourcing noncritical functions, including allowing you as a business owner to focus on other functions. RSM’s FAO technology is scalable, accessible through the cloud and provides real-time, automated reporting. We work with leading technology partners such as Oracle NetSuite, Sage Intacct, Intuit QuickBooks, Blackline, Tallie and Bill.com. Platforms are regularly upgraded without affecting functionality and as improved technology becomes available, we enhance platform offerings as appropriate, so it’s always up to date. Outsourced accounting services have become a more common and practical solution for various businesses today.

Outsourced accounting can benefit a wide range of business types and sizes, from small startups to mid-size companies. Regardless of industry or rate of growth, companies can find value in hiring an external firm to handle accounting services and improve financial reporting. To meet their needs, RSM provides outsourcing solutions that cost-effectively improve finance and accounting functions.