That may abandon a great number off financing, analysts state

Slowly and gradually, scores of People in the us surrendered collateral within their property in recent times. Lulled from the good times, it borrowed ? possibly heavily ? resistant to the roofs more their heads.

Today the balance is originating owed. Since the housing market spirals downwards, home guarantee finance, and that turn family sweet home on cash sweet cash, are receiving the following thumb reason for the borrowed funds drama.

Us citizens are obligated to pay a staggering $step one.1 trillion on the family security finance ? and you may banking companies was increasingly concerned they may maybe not find some out-of that money right back.

For example methods are limiting perform by plan brands to help battling property owners get easier terms to their mortgage loans and you may base brand new rising wave out-of foreclosure. But at once when day-after-day seems to provide way more bad news for the monetary world, loan providers safeguard the tough-nosed moves as a way to keep her losings from deepening.

It is a beneficial reericans that have visited admiration a house as a the.T.Meters. that have about three bed rooms and you will step one.5 shower enclosures. Whenever times was indeed a great, it borrowed against their houses to pay for all kinds of some thing, out-of new vehicles to college educations so you’re able to a home theater.

Loan providers in addition to encouraged of several aspiring residents to carry out not one however, a few mortgages on top of that ? ordinary ones and piggyback finance ? to cease getting any money down.

As a result, a nation that merely 50 % of-has their homes. If you’re homeownership climbed to help you list heights in recent times, home collateral ? the value of the new features without mortgages up against him or her ? have fell lower than 50 percent the very first time, according to the Government Put aside.

Loan providers holding very first mortgage loans get earliest dibs towards borrowers’ bucks otherwise into the belongings is someone get behind to their money. Banks that generated domestic guarantee funds is actually second in line. Which arrangement often pits you to bank against several other.

When individuals standard on the mortgage loans, loan providers foreclose market this new homes to recoup their cash. However when belongings sell for lower than the worth of their mortgage loans and you may domestic guarantee funds ? the right position also known as a preliminary business ? lenders which have first liens have to be settled completely ahead of owners off second or third liens get a dime.

Inside the metropolitan areas for example Ca, Las vegas, Arizona and Florida, where home values features fell notably, second-lien people is going to be leftover with little to no otherwise little immediately after very first mortgages try paid off.

In the December, 5.seven per cent out of house equity credit lines was indeed unpaid or for the default, upwards from 4.5 per cent for the 2006, according to Moody’s Benefit.

Lenders and you will buyers exactly who hold domestic collateral financing are not providing upwards without difficulty, however. As an alternative, he’s face-to-face short sales. And some banking institutions holding second liens are also reverse refinancings to possess very first mortgage loans, a small-made use of energy he’s in law, in an effort to force individuals to pay off its finance.

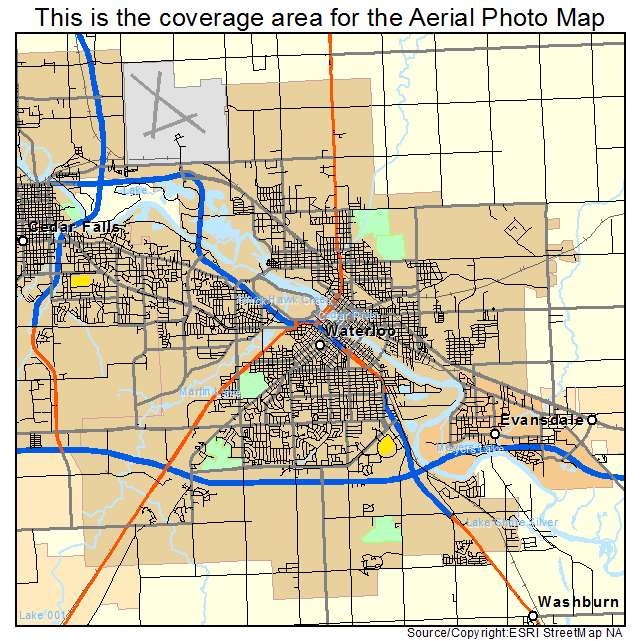

Taking a loss is one of hard action to take, told you Micheal Thompson, new government director of your own Iowa Mediation Provider, that has been working with outstanding borrowers and you can loan providers. You have got to manage the facts out of what you’re against now.

As he might have been in a position to hit specific income, Mr. Thompson mentioned that of many financial people the guy discussions having refuse to lose. People off second mortgage loans tend to invest in quick conversion or other alter on condition that basic-lien proprietors outlay cash a small share, say $10,100, otherwise 10 %, toward good $one hundred,000 loans.

Conflicts arise in the event that first and you can 2nd liens take place because of the various other financial institutions otherwise buyers. If an individual lender keeps one another expenses, it is within their attract to obtain an answer.

Whenever purchases can not be exercised, second-lien proprietors is realize the brand new outstanding harmony even after foreclosures, often owing to collection agencies. The new soured household guarantee expense is also linger to the borrowing suggestions and allow much harder for all those to help you use afterwards.

Advantages state its within the everyone’s notice to settle these types of loans, but doing this is not always effortless. Thought Randy and you will Beginning McLain of Phoenix. The couple decided to sell their property after shedding trailing into the their first-mortgage away from Pursue and you may a house security distinctive line of borrowing regarding CitiFinancial this past year, immediately after Randy McLain resigned on account of an in the past burns. The happy couple due $370,100 altogether.

To have it, of a lot lenders are taking the outrageous action away from blocking some people away from attempting to sell their houses otherwise refinancing the mortgages unless they pay from all the otherwise element of their home collateral fund earliest

Immediately after 90 days, the happy couple found a purchaser ready to shell out throughout the $3 hundred,100000 due to their house ? a statistic symbolizing a keen 18 per cent loan places Brookside, after they got out their property collateral line of credit. (Single-home pricing within the Phoenix have dropped on 18 per cent because the the summer months of 2006, depending on the Important & Poor’s Instance-Shiller list.)

CitiFinancial, which was owed $95,five hundred, refused the offer whilst will have paid off the initial financial in full however, will have kept it with just $step one,100, immediately following costs and you can settlement costs, on credit line. The true auctions which worked tirelessly on the newest marketing declare that package remains much better than the one the lender carry out get in case your home is foreclosed to your and you will offered on a public auction in some days.

Whether it goes into foreclosures, which it is extremely going to do anyway, you wouldn’t rating anything, told you J. D. Dougherty, an agent whom portrayed the consumer toward purchase.

We strive to locate options that are appropriate toward some people inside it, the guy said but a couple lenders can worthy of the house in a different way.

Most other lenders such National Area, the financial institution based in Cleveland, have banned home owners away from refinancing basic mortgages unless of course the latest borrowers spend off of the next lien held of the financial first. However, such as for instance projects hold tall risk, told you Michael Youngblood, a portfolio director and you may specialist on Friedman, Billings, Ramsey, new ties organization. This may as well as impel the fresh borrower in order to file for bankruptcy, and you can a courtroom you certainly will take note of the worth of the second financial, he told you.

Good spokeswoman to possess National Urban area, Kristen Baird Adams, told you the insurance policy applied in order to family collateral loans got its start by the mortgage brokers.

Underscoring the issues gonna develop at home equity loans, good Popular proposition within the Congress so you can refinance troubled mortgage loans and supply these with government backing specifically excludes second liens. Lenders carrying an extra lien could well be necessary to discount their costs up until the very first financing would be refinanced.

People who have weak, or subprime, credit will be harm the absolute most. Over a third of all the subprime finance produced in 2006 got related 2nd-lien financial obligation, right up off 17 per cent for the 2000, predicated on Borrowing from the bank Suisse. And several some one extra second finance immediately after taking right out first mortgage loans, so it’s impossible to say for sure just how many home owners have several liens to their characteristics.